Did The Income Tax Rate Change In 2022 . Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore may introduce a minimum effective tax rate (metr) regime. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. This increase in the top marginal personal income tax is expected to affect the top 1.2. Singapore personal income tax tables in 2022. Top marginal personal income tax (pit) rate to be increased to 24%.

from www.gao.gov

Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore personal income tax tables in 2022. Top marginal personal income tax (pit) rate to be increased to 24%. Singapore may introduce a minimum effective tax rate (metr) regime. This increase in the top marginal personal income tax is expected to affect the top 1.2.

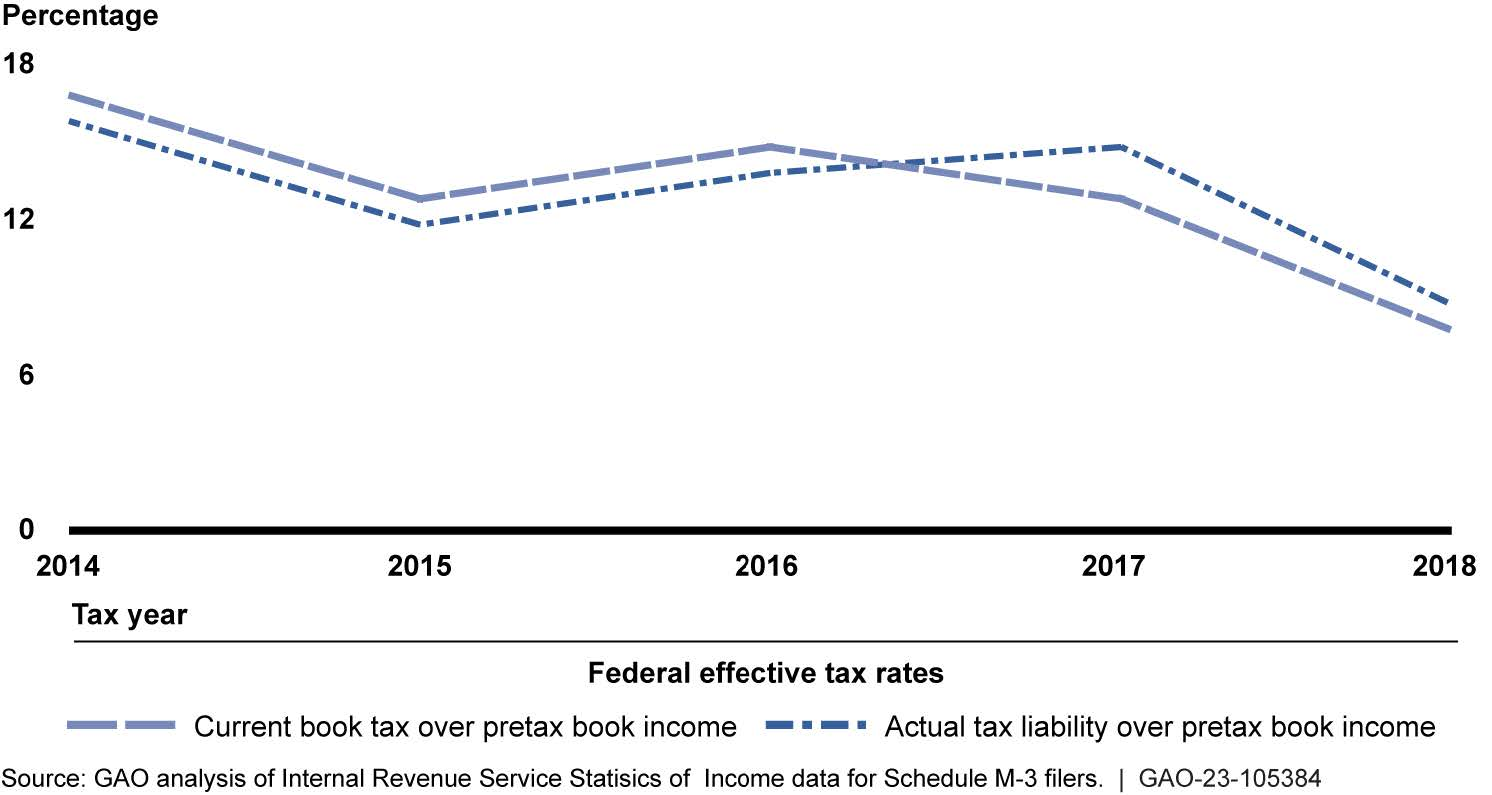

Corporate Tax Effective Rates Before and After 2017 Law Change

Did The Income Tax Rate Change In 2022 Singapore personal income tax tables in 2022. Singapore may introduce a minimum effective tax rate (metr) regime. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore personal income tax tables in 2022. Top marginal personal income tax (pit) rate to be increased to 24%. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. This increase in the top marginal personal income tax is expected to affect the top 1.2.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax Did The Income Tax Rate Change In 2022 Singapore personal income tax tables in 2022. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Top marginal personal income tax (pit) rate to be increased to 24%. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore may introduce a minimum effective tax. Did The Income Tax Rate Change In 2022.

From www.financialsamurai.com

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026 Did The Income Tax Rate Change In 2022 Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from. Did The Income Tax Rate Change In 2022.

From laptrinhx.com

Tax Season 2022 Starts Strong LaptrinhX / News Did The Income Tax Rate Change In 2022 This increase in the top marginal personal income tax is expected to affect the top 1.2. Singapore personal income tax tables in 2022. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate. Did The Income Tax Rate Change In 2022.

From www.newswire.lk

Corporate Tax Govt gives details of Jan 1st new rates Newswire Did The Income Tax Rate Change In 2022 Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore may introduce a minimum effective tax rate (metr) regime. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. This increase in the top marginal personal income tax is expected to affect the top 1.2.. Did The Income Tax Rate Change In 2022.

From www.wwltv.com

The History of Federal Tax Rates Did The Income Tax Rate Change In 2022 Singapore may introduce a minimum effective tax rate (metr) regime. Singapore personal income tax tables in 2022. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. This increase in the top marginal personal income tax. Did The Income Tax Rate Change In 2022.

From usafacts.org

How much money does the government collect per person? Did The Income Tax Rate Change In 2022 Singapore personal income tax tables in 2022. Top marginal personal income tax (pit) rate to be increased to 24%. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with. Did The Income Tax Rate Change In 2022.

From www.democraticunderground.com

Our tax structure used to be much more progressive than it is today. 99 Did The Income Tax Rate Change In 2022 Singapore may introduce a minimum effective tax rate (metr) regime. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Top marginal personal income tax (pit) rate to be increased to 24%. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to. Did The Income Tax Rate Change In 2022.

From businessnews.in

Tax Calculator India ★ (FY 202122) (AY 202223) ★ Did The Income Tax Rate Change In 2022 This increase in the top marginal personal income tax is expected to affect the top 1.2. Singapore may introduce a minimum effective tax rate (metr) regime. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Income in excess of $320,000 up to. Did The Income Tax Rate Change In 2022.

From www.pitcher.com.au

Federal Budget 202324 Personal tax Pitcher Partners Did The Income Tax Rate Change In 2022 Singapore may introduce a minimum effective tax rate (metr) regime. Singapore personal income tax tables in 2022. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. This increase in the top marginal personal income tax is expected to affect the top 1.2.. Did The Income Tax Rate Change In 2022.

From sachkais.blogspot.com

Tax Rate 2016 / 2020 federal tax brackets. sachkais Did The Income Tax Rate Change In 2022 Singapore personal income tax tables in 2022. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore may introduce a minimum effective tax rate (metr) regime. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from. Did The Income Tax Rate Change In 2022.

From kamicartwright.blogspot.com

tax rates 2022 vs 2021 Kami Cartwright Did The Income Tax Rate Change In 2022 Singapore personal income tax tables in 2022. Top marginal personal income tax (pit) rate to be increased to 24%. This increase in the top marginal personal income tax is expected to affect the top 1.2. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore's personal income tax regime will be enhanced. Did The Income Tax Rate Change In 2022.

From kamicartwright.blogspot.com

tax rates 2022 vs 2021 Kami Cartwright Did The Income Tax Rate Change In 2022 Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Singapore may introduce a minimum effective tax rate (metr) regime. This increase in the top marginal personal income tax is expected to affect the top 1.2. Singapore personal income tax tables in 2022.. Did The Income Tax Rate Change In 2022.

From mbmg-group.com

5 Steps to Plan Your Personal Tax 2022 to Have More Savings 💰 Did The Income Tax Rate Change In 2022 Singapore personal income tax tables in 2022. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. This increase in the top marginal personal income tax is expected to affect the top 1.2. Singapore may introduce a minimum effective tax rate (metr) regime. Top marginal personal income tax (pit) rate to be increased. Did The Income Tax Rate Change In 2022.

From edu.thainfo.info

Personal Tax คือ อะไร ความรู้และความเข้าใจ Did The Income Tax Rate Change In 2022 Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Singapore may introduce a minimum effective tax rate (metr) regime. This increase in the top marginal personal income tax is expected to affect the top 1.2. Top marginal personal income tax (pit) rate. Did The Income Tax Rate Change In 2022.

From bizsewa.com

Tax rates in Nepal 2079/2080 (Corporation, Individual, and Couple) Did The Income Tax Rate Change In 2022 Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Top marginal personal income tax (pit) rate to be increased to 24%. Income in excess of. Did The Income Tax Rate Change In 2022.

From topdollarinvestor.com

2023 Tax Rates & Federal Tax Brackets Top Dollar Did The Income Tax Rate Change In 2022 Singapore may introduce a minimum effective tax rate (metr) regime. Top marginal personal income tax (pit) rate to be increased to 24%. Singapore personal income tax tables in 2022. This increase in the top marginal personal income tax is expected to affect the top 1.2. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22. Did The Income Tax Rate Change In 2022.

From learn.financestrategists.com

Gift Tax Limit 2022 Calculation, Filing, and How to Avoid Gift Tax Did The Income Tax Rate Change In 2022 This increase in the top marginal personal income tax is expected to affect the top 1.2. Singapore personal income tax tables in 2022. Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Income in excess of $320,000 up to $500,000 will continue to be taxed at 22 per cent. Singapore may introduce. Did The Income Tax Rate Change In 2022.

From www.theglobaleye.it

G7/Financial and Systems Corporate tax isn’t working how Did The Income Tax Rate Change In 2022 Income tax act changes effective from various dates to implement tax changes announced in 2022 budget statement. Singapore's personal income tax regime will be enhanced to be more progressive, with the top marginal personal income tax rate to be increased with effect from the. Singapore personal income tax tables in 2022. Income in excess of $320,000 up to $500,000 will. Did The Income Tax Rate Change In 2022.